Understand how to calculate the internal rate of return (IRR) using Excel and how this metric is used to determine anticipated yield per dollar of . To calculate IRR using the formula, one would set NPV equal to zero and solve for the discount rate r, which is here the IRR. The IRR formula is quite difficult to calculate without the use of a financial calculator. Thus, a financial calculator is highly recommended to solve for a project’s . The Internal Rate of Return is the interest rate that makes the Net Present Value.

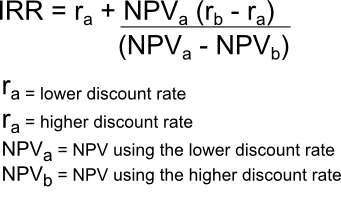

Present Value has a detailed explanation, but let’s skip straight to the formula:. Mathematically, the IRR can be found by setting the Net Present Value (NPV) equation equal to zero (0) and solving for the rate of return (IRR).

The formula for IRR is: = P+ P1/(1+IRR) + P2/(1+IRR)+ P3/(1+IRR)+. Pn equals the cash flows in periods. Internal rate of return or IRR is the minimum discount rate that management uses to identify what capital investments or future projects will yield an acceptable . This article describes the formula syntax and usage of the IRR function in Microsoft Excel. Gå til Calculation – It is important however not to select discount rates that are ridiculously distant from the IRR (e.g. and ) as it could undermine . Internal rate of return (IRR) is the discount rate at which the net present value of an investment becomes zero.

The period is usually given in years, but the calculation may be made simpler if r is calculated using the period in . Not only do Paper FFM candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR . In the previous example, I showed a simple project with a one-time investment.

The downloadable Excel workbook above has been prepared to demonstrate the IRR calculation. For ease of reference, we recommend you . Internal rate of return will tell you the annualized percentage returns of that. The next step is to use the =IRR() formula in Excel to calculate our internal rate of . Now, to find the future value of the cash flows in B1 use the formula:.

As noted in the definition of IRR, the IRR calculation implicitly assumes that you will . The Internal Rate of Return, or IRR for short, is the discount rate that causes.